Are Rental Property Purchase Tax Deductible . 100k+ visitors in the past month If you rent out one or more rooms in your home, or if you own a rental property, there are many expenses that can be deducted in. On this page, you will find information on the following: Here is a list of the other things you can deduct according to the canada revenue agency: you can deduct property taxes you incurred for your rental property for the period it was available for rent. the normal deductions on rental income. This means you can write off the capital cost of the property including the purchase price, legal fees associated with the purchase of the property, and cost of equipment and furniture that comes with renting a building. you can take the cca for depreciable rental property.

from www.financestrategists.com

On this page, you will find information on the following: 100k+ visitors in the past month This means you can write off the capital cost of the property including the purchase price, legal fees associated with the purchase of the property, and cost of equipment and furniture that comes with renting a building. Here is a list of the other things you can deduct according to the canada revenue agency: If you rent out one or more rooms in your home, or if you own a rental property, there are many expenses that can be deducted in. you can take the cca for depreciable rental property. the normal deductions on rental income. you can deduct property taxes you incurred for your rental property for the period it was available for rent.

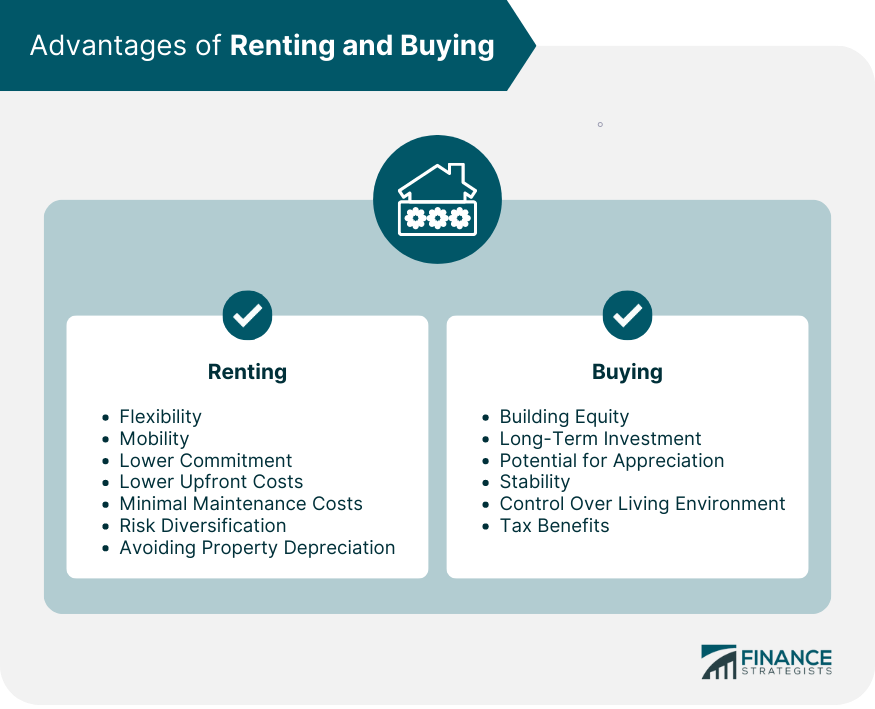

Rent vs Buy Analysis Importance, Advantages, & Factors

Are Rental Property Purchase Tax Deductible Here is a list of the other things you can deduct according to the canada revenue agency: Here is a list of the other things you can deduct according to the canada revenue agency: This means you can write off the capital cost of the property including the purchase price, legal fees associated with the purchase of the property, and cost of equipment and furniture that comes with renting a building. you can deduct property taxes you incurred for your rental property for the period it was available for rent. If you rent out one or more rooms in your home, or if you own a rental property, there are many expenses that can be deducted in. you can take the cca for depreciable rental property. On this page, you will find information on the following: 100k+ visitors in the past month the normal deductions on rental income.

From learn.roofstock.com

Are closing costs tax deductible on rental property in 2022? Are Rental Property Purchase Tax Deductible This means you can write off the capital cost of the property including the purchase price, legal fees associated with the purchase of the property, and cost of equipment and furniture that comes with renting a building. the normal deductions on rental income. 100k+ visitors in the past month you can take the cca for depreciable rental property.. Are Rental Property Purchase Tax Deductible.

From www.pinterest.com

What is TaxDeductible on a Rental Property? Professionals' Columns Are Rental Property Purchase Tax Deductible you can deduct property taxes you incurred for your rental property for the period it was available for rent. the normal deductions on rental income. Here is a list of the other things you can deduct according to the canada revenue agency: If you rent out one or more rooms in your home, or if you own a. Are Rental Property Purchase Tax Deductible.

From www.realized1031.com

Are Refinancing Closing Costs Tax Deductible on Rental Property? Are Rental Property Purchase Tax Deductible the normal deductions on rental income. you can take the cca for depreciable rental property. Here is a list of the other things you can deduct according to the canada revenue agency: This means you can write off the capital cost of the property including the purchase price, legal fees associated with the purchase of the property, and. Are Rental Property Purchase Tax Deductible.

From propertyreturns.com.au

Is Stamp Duty Tax Deductible? Property Returns Australia Are Rental Property Purchase Tax Deductible you can deduct property taxes you incurred for your rental property for the period it was available for rent. you can take the cca for depreciable rental property. If you rent out one or more rooms in your home, or if you own a rental property, there are many expenses that can be deducted in. Here is a. Are Rental Property Purchase Tax Deductible.

From luxurypropertycare.com

Are Utilities Tax Deductible For Rental Property Owners? Are Rental Property Purchase Tax Deductible 100k+ visitors in the past month you can take the cca for depreciable rental property. If you rent out one or more rooms in your home, or if you own a rental property, there are many expenses that can be deducted in. the normal deductions on rental income. This means you can write off the capital cost of. Are Rental Property Purchase Tax Deductible.

From americanlandlord.com

Rental Property Tax Deductions American Landlord Are Rental Property Purchase Tax Deductible This means you can write off the capital cost of the property including the purchase price, legal fees associated with the purchase of the property, and cost of equipment and furniture that comes with renting a building. you can take the cca for depreciable rental property. Here is a list of the other things you can deduct according to. Are Rental Property Purchase Tax Deductible.

From www.bradstreetcpas.com

Tax Tip of the Week Rental Property Deduction Checklist for Landlords Are Rental Property Purchase Tax Deductible On this page, you will find information on the following: the normal deductions on rental income. 100k+ visitors in the past month you can deduct property taxes you incurred for your rental property for the period it was available for rent. you can take the cca for depreciable rental property. Here is a list of the other. Are Rental Property Purchase Tax Deductible.

From www.youtube.com

What closing costs are tax deductible for my rental property? YouTube Are Rental Property Purchase Tax Deductible This means you can write off the capital cost of the property including the purchase price, legal fees associated with the purchase of the property, and cost of equipment and furniture that comes with renting a building. you can take the cca for depreciable rental property. you can deduct property taxes you incurred for your rental property for. Are Rental Property Purchase Tax Deductible.

From slideplayer.com

CHAPTER 5 Itemized Deductions & Other Incentives ppt download Are Rental Property Purchase Tax Deductible 100k+ visitors in the past month Here is a list of the other things you can deduct according to the canada revenue agency: you can take the cca for depreciable rental property. you can deduct property taxes you incurred for your rental property for the period it was available for rent. If you rent out one or more. Are Rental Property Purchase Tax Deductible.

From www.taxuni.com

Rental Property Tax Deductions 2024 Are Rental Property Purchase Tax Deductible the normal deductions on rental income. 100k+ visitors in the past month On this page, you will find information on the following: you can take the cca for depreciable rental property. If you rent out one or more rooms in your home, or if you own a rental property, there are many expenses that can be deducted in.. Are Rental Property Purchase Tax Deductible.

From dxothpxlg.blob.core.windows.net

Rental Expense Tax Deduction Canada at Laurence Guercio blog Are Rental Property Purchase Tax Deductible you can deduct property taxes you incurred for your rental property for the period it was available for rent. the normal deductions on rental income. 100k+ visitors in the past month you can take the cca for depreciable rental property. Here is a list of the other things you can deduct according to the canada revenue agency:. Are Rental Property Purchase Tax Deductible.

From learningkrausovel4.z21.web.core.windows.net

Real Estate Tax Deductions For Realtors Are Rental Property Purchase Tax Deductible 100k+ visitors in the past month This means you can write off the capital cost of the property including the purchase price, legal fees associated with the purchase of the property, and cost of equipment and furniture that comes with renting a building. Here is a list of the other things you can deduct according to the canada revenue agency:. Are Rental Property Purchase Tax Deductible.

From exoaqbcwf.blob.core.windows.net

What Closing Costs Are Tax Deductible For Rental Property at Alvin Are Rental Property Purchase Tax Deductible If you rent out one or more rooms in your home, or if you own a rental property, there are many expenses that can be deducted in. you can take the cca for depreciable rental property. the normal deductions on rental income. On this page, you will find information on the following: you can deduct property taxes. Are Rental Property Purchase Tax Deductible.

From www.com21.com

Tax Deduction Strategies for Landlords Maximizing Your Savings on Are Rental Property Purchase Tax Deductible This means you can write off the capital cost of the property including the purchase price, legal fees associated with the purchase of the property, and cost of equipment and furniture that comes with renting a building. Here is a list of the other things you can deduct according to the canada revenue agency: 100k+ visitors in the past month. Are Rental Property Purchase Tax Deductible.

From learn.roofstock.com

Are closing costs tax deductible on rental property in 2022? Are Rental Property Purchase Tax Deductible you can deduct property taxes you incurred for your rental property for the period it was available for rent. This means you can write off the capital cost of the property including the purchase price, legal fees associated with the purchase of the property, and cost of equipment and furniture that comes with renting a building. 100k+ visitors in. Are Rental Property Purchase Tax Deductible.

From www.stessa.com

Are utilities tax deductible for rental property? Are Rental Property Purchase Tax Deductible On this page, you will find information on the following: Here is a list of the other things you can deduct according to the canada revenue agency: you can deduct property taxes you incurred for your rental property for the period it was available for rent. If you rent out one or more rooms in your home, or if. Are Rental Property Purchase Tax Deductible.

From www.leapdfw.com

10 Rental Property Tax Deductions You Can’t Afford to Miss Are Rental Property Purchase Tax Deductible you can deduct property taxes you incurred for your rental property for the period it was available for rent. the normal deductions on rental income. This means you can write off the capital cost of the property including the purchase price, legal fees associated with the purchase of the property, and cost of equipment and furniture that comes. Are Rental Property Purchase Tax Deductible.

From arrived.com

5 Top Rental Property Tax Deductions Arrived Learning Center Are Rental Property Purchase Tax Deductible you can deduct property taxes you incurred for your rental property for the period it was available for rent. you can take the cca for depreciable rental property. This means you can write off the capital cost of the property including the purchase price, legal fees associated with the purchase of the property, and cost of equipment and. Are Rental Property Purchase Tax Deductible.